Strategic by Design: Why Payroll is the Backbone of Modern Australian Business

Australia’s payroll industry is undergoing a transformation as profound as it is overdue. The convergence of compliance complexity, digital innovation, and shifting workforce expectations is reshaping the way organisations manage one of their most critical functions. In 2025, payroll has moved beyond its traditional back-office status, evolving into a strategic function that delivers operational agility, compliance confidence, and business intelligence. Central to this shift is the adoption of modern, automated, and integrated payroll platforms, many of them developed locally and specifically designed for Australia’s regulatory and workforce environment.

The Legacy Systems Reckoning

For decades, Australian organisations have operated on payroll systems that, while once dependable, are increasingly incompatible with today’s business realities. Many of these platforms are outdated, unsupported, or ill-equipped to manage Australia’s complex legislative environment. As vendor support diminishes and technologies are phased out, operational risk has become a pressing concern.

The cost of inertia is rising. Payroll errors missed superannuation payments, and misaligned award interpretations can now lead to significant penalties under tightened regulations. In an environment of heightened Fair Work enforcement and rising wage theft scrutiny, relying on patchworked legacy systems is a gamble few can afford.

The 2025 Australian Payroll Industry Report underscores the mounting urgency for change, highlighting the growing disconnect between outdated systems and contemporary business needs. With only 45% of employers expecting sales growth this year, down from 53% in 2024, cost control and process efficiency have taken centre stage. Payroll, once a passive function, is now integral to resilience, compliance, and reputational protection¹.

The Rise of Automation and Intelligence

Automation and artificial intelligence (AI) are no longer speculative technologies, they are already embedded in the workflows of leading payroll teams. The data shows a sharp uptick in adoption, with 86% of HR professionals acknowledging the transformative potential of AI in their operations for 2025, and 68% expressing readiness to embrace this shift².

Crucially, automation is not only streamlining repetitive tasks like data validation and award interpretation; it is also significantly reducing manual error rates and improving overall processing times. AI-enhanced platforms now offer predictive analytics, anomaly detection, and real-time compliance alerts, transforming payroll from a reactive to a proactive discipline.

Australia’s unique and often volatile regulatory landscape necessitates solutions that are both agile and locally attuned. Unlike generalist systems repurposed from overseas markets, purpose-built Australian platforms are engineered with specific compliance requirements in mind. This includes updates to superannuation thresholds, Fair Work provisions, tax changes, and state-based obligations, all delivered via continuous, localised updates³.

Integration: More Than Just Efficiency

Barriers to Transformation Remain

Despite the clear benefits, payroll transformation is not without its challenges. Cost remains a key barrier, particularly for small to medium-sized enterprises (SMEs). The upfront investment in new platforms, coupled with the resource requirements for implementation and training, can be difficult to justify without a clear business case.

Complexity is another hurdle. Migrating data from legacy systems requires thorough planning, rigorous data cleansing, and an ability to manage risk during transitional periods. Additionally, cultural resistance, especially within established payroll teams, is a common obstacle. Habits formed over decades can be hard to shift without clear leadership, training, and demonstrable value.

However, there is increasing recognition that the right payroll partner is not the largest or most global provider, but the one with the deepest understanding of Australia’s payroll environment. Locally developed systems offer a degree of customisation, responsiveness, and legislative insight that offshore alternatives struggle to match⁵.

Elevating Payroll Capability

As payroll systems become more sophisticated, the skillsets required to manage them are also evolving. No longer solely administrative, the payroll function is now analytical, strategic, and increasingly tech-driven.

According to recent industry insights, 37% of Australian HR leaders now prioritise AI proficiency and data fluency in payroll roles, up from 25% just one year earlier⁶. Payroll professionals must not only understand compliance rules, but also be adept at using automation tools, interpreting analytics, and contributing to workforce strategy.

The upskilling imperative is also a retention strategy. As competition for skilled payroll professionals intensifies, organisations that invest in professional development are more likely to retain top talent, build internal capability, and reduce reliance on external consultants.

A Practical Roadmap for Change

Organisations embarking on payroll transformation should take a structured, strategic approach. The following six steps provide a practical guide for Australian businesses navigating this journey:

Compliance as a Strategic Imperative

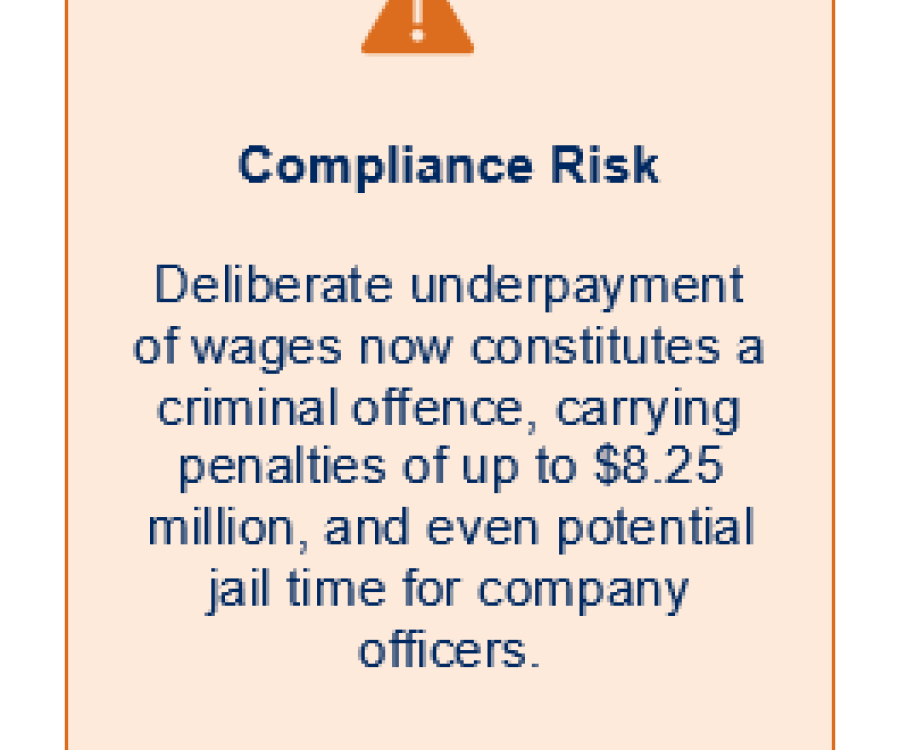

Compliance has always been a non-negotiable in Australian payroll, but in 2025 it is more consequential than ever. Changes to the Fair Work Act mean that deliberate underpayment of wages now constitutes a criminal offence, carrying penalties of up to $8.25 million, and even potential jail time for company officers⁷.

This has elevated payroll compliance from an operational concern to a board-level issue. Businesses are actively seeking systems that can perform real-time compliance checks, automatically interpret awards, and generate audit-ready documentation at the click of a button.\

Locally built payroll platforms have a distinct edge in this space. They are engineered to accommodate the full range of national and state-based obligations and are supported by onshore teams with first-hand understanding of local legislation. In a market where a compliance failure can destroy trust and brand value, this level of alignment is invaluable³.

Delivering a Better Employee Experience

The employee experience has emerged as a differentiator in Australia’s competitive labour market, and payroll is playing a central role. Accurate, timely payments are a minimum requirement. What sets employers apart is the ability to deliver transparency, flexibility, and accessibility.

Modern Australian payroll platforms are increasingly mobile-first, allowing employees to view payslips, manage leave, and update personal details from anywhere. This accessibility supports flexible work arrangements and reinforces trust in the employer.

Furthermore, innovations such as earned wage access and on-demand pay options improve employee engagement and financial wellbeing. Research suggests that organisations with high payroll satisfaction also benefit from lower turnover, stronger culture, and improved productivity⁸.

What’s Next: Payroll as a Business Driver

The evolution of payroll in Australia is ongoing, but the direction of travel is clear. As technology advances and legislation continues to shift, payroll leaders must remain vigilant, strategic, and open to continuous improvement.

Organisations that embrace locally built, integrated payroll systems are not just solving today’s compliance and efficiency challenges, they are future-proofing their operations.

By aligning payroll with broader business strategy, they are turning a traditionally reactive function into a source of competitive advantage.

In the years ahead, payroll will not just support the business, it will help shape it.