Payroll Meets Climate Compliance: How Your Workforce Data Drives Australia’s Sustainability Reporting

Your payroll system might just be your next ally in navigating Australia’s climate compliance landscape. With mandatory climate reporting now underway for the country’s largest organisations since 1 January 2025, a surprising player has stepped into the spotlight: payroll.

What was once a function seen purely as transactional is now carrying unexpected strategic weight. Under the new Australian Sustainability Reporting Standards (ASRS), organisations must disclose Scope 3 emissions - the indirect greenhouse gases created up and down the value chain. That means not just trucks on the road or energy in the office, but also how staff travel to work, the flights booked for business trips, and even the balance of remote versus in-office days. And much of this information flows, in some form, through payroll.

Far from being a back-office utility, payroll may now be one of the most practical tools available for helping organisations measure and report on their environmental impact.

A Shift in Responsibility

For years, climate reporting was seen as the realm of sustainability officers and environmental consultants. But the introduction of ASRS has shifted expectations. Finance and risk teams are taking the lead in compiling disclosures, yet they are quickly discovering that they cannot deliver without input from HR and payroll.

Why payroll? Because it is the most reliable single source of workforce data inside most organisations. From employee addresses (essential for modelling commuting patterns) to expense reimbursements (for mileage and public transport), payroll captures touchpoints that feed directly into emissions calculations.

This does not mean payroll professionals are expected to turn into climate scientists overnight. Instead, their role is becoming one of data custodian ensuring that the information organisations already collect is accurate, complete, and accessible for climate reporting purposes. In this sense, payroll is evolving from a compliance obligation into a compliance enabler.

Scope 3: Where Payroll Comes In

The Scope 1 and Scope 2 emissions that an organisation produces directly or through purchased energy, are comparatively straightforward to measure. Scope 3 is where complexity arises, and where payroll starts to matter.

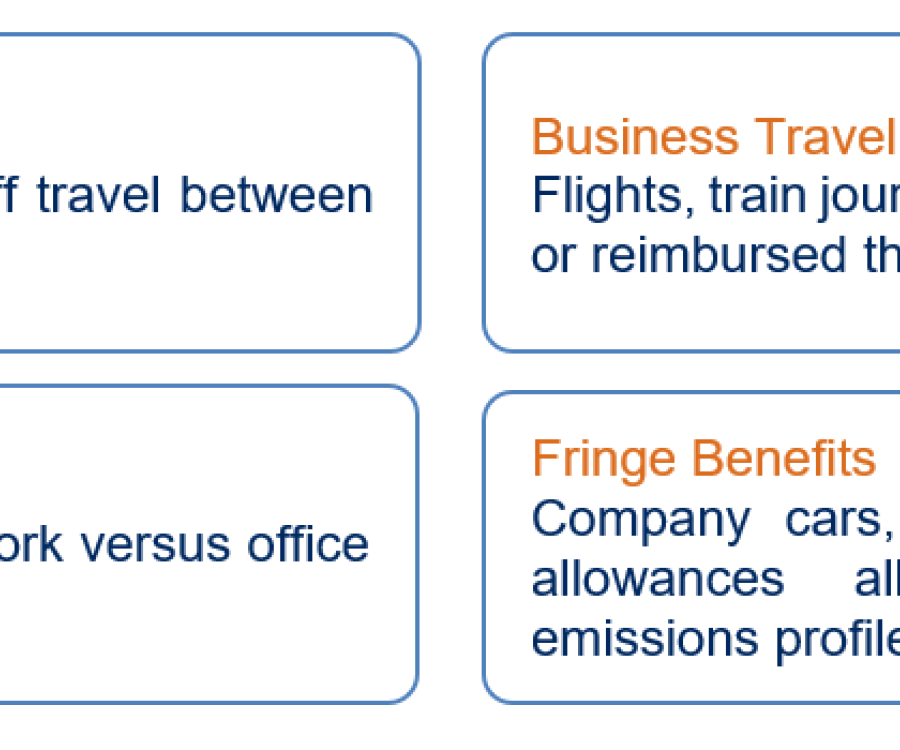

Examples include:

While payroll cannot deliver every data point in perfect form, it holds threads that, when woven together with finance and operations data, can provide a meaningful picture. That makes payroll a bridge between workforce behaviour and sustainability reporting.

Payroll as a Strategic Ally

The idea that payroll could be an ally in environmental compliance may feel counterintuitive. Payroll is usually associated with accuracy, timeliness, and legislative adherence – not carbon accounting. But therein lies its value.

Payroll teams are already experts at dealing with sensitive data, applying rigorous controls, and producing records that stand up to audit. Those same qualities make payroll systems uniquely suited to underpin climate disclosures, which will be subject to the same level of scrutiny as financial reporting.

For HR and payroll professionals, this shift opens the door to a new conversation about their role in the organisation. Rather than being seen solely as administrators, they can position themselves as contributors to the organisation’s broader Environmental, Social, and Governance (ESG) agenda.

The Compliance Timeline

The rollout of mandatory climate reporting is staged, beginning with the largest entities in 2025, then progressively extending to medium and smaller listed organisations. While some employers may be outside the immediate scope, few can assume they are unaffected.

Even organisations not directly captured, may still feel the ripple. Larger clients, partners, or suppliers may demand emissions data from the companies they work with, creating a trickle-down compliance effect. Payroll data, once again, will form part of the story.

Data Gaps and Practical Challenges

Of course, this new role for payroll is not without hurdles. Existing systems were not designed to calculate carbon footprints. Employee commuting data, for example, is rarely tracked in detail. Business travel expenses might be recorded but not consistently categorised by mode of transport. Hybrid work arrangements may be understood informally but not systematically captured.

Here payroll must act less as a finished product and more as a starting point. Collaboration with HR, facilities, and finance teams will be essential to fill the gaps. Surveys may need to be conducted to understand commuting behaviours. Expense codes may need refinement for different categories, such as air travel, ground transport, etc.

Payroll systems themselves may need enhancement, either through configuration changes or integration with sustainability platforms. This creates both a challenge and an opportunity: by shaping how data is captured today, payroll professionals can make tomorrow’s reporting easier, more reliable, and more credible.

Risk and Reputation

Climate disclosures are not a “nice to have.” They are legally binding, and false or misleading reports carry penalties. Organisations that treat reporting as a tick-box exercise, risk reputational damage and regulatory exposure.

Here again, payroll can be a quiet but powerful ally. By providing high-quality workforce data, payroll strengthens the credibility of disclosures. Inaccurate or patchy workforce information, on the other hand, can leave organisations vulnerable to scrutiny.

The reputational dimension also matters. Employees, investors, and customers are watching closely. When organisations can show that even their payroll function is aligned with ESG objectives, it sends a message of thoroughness and integrity.

From Burden to Asset

The key question is whether payroll teams view this shift as a burden or as an opportunity. The burden is real: there will be more requests for data, more collaboration across departments, and more pressure on accuracy. But the opportunity is greater. Payroll has a chance to redefine itself as part of an organisation’s strategic toolkit.

By leaning into this role, payroll professionals can:

Elevate their visibility and influence within the organisation.

Demonstrate adaptability and relevance in a changing regulatory environment.

Contribute to sustainability goals that resonate with employees and stakeholders alike.

In short, payroll can move from the margins of compliance to the centre of strategy.

Preparing Now

Even if your organisation is not yet captured by the reporting deadlines, it is worth preparing. Practical steps include:

These early moves can ease the compliance burden later, and more importantly, position payroll as a trusted partner in the organisation’s ESG journey.

The Bigger Picture

Australia is not acting in isolation. Similar disclosure regimes are emerging in the UK, New Zealand, and the EU, with global convergence increasingly likely. For multinational employers, aligning payroll systems to support emissions reporting, across jurisdictions, will become not just a regulatory necessity, but a competitive advantage.

Payroll, once overlooked, is now part of a global conversation about sustainability. And in that conversation, it can be more than just a record of salaries and tax. It can be a tool for compliance, a weapon to protect reputational risk, and an ally in building trust with stakeholders.

Conclusion

The story of payroll in 2025 is no longer just about accuracy and timeliness. It is about relevance in a world where compliance is expanding into new frontiers. Payroll may not have asked for a seat at the climate reporting table, but it has been handed one and how professionals use it, will shape both their own future and their organisation’s credibility.

So, when thinking about climate disclosure, do not overlook the data flowing through your payroll system. It might just be your next ally in navigating the complex, high-stakes compliance landscape.