The Gig Economy Super Trap: When Workers Aren’t Employees

Millions of Australians now find work through the gig economy, yet a complex classification maze is leaving many without superannuation, and employers facing unexpected penalties. As the gig economy fundamentally reshapes how Australians work, a critical gap remains in worker protections.

Most gig workers do not fall under the Superannuation Guarantee (SG), meaning they miss out on retirement savings. This classification challenge creates a web of compliance risks for businesses and financial insecurity for workers navigating Australia's evolving employment landscape.

The Stakes: Superannuation and the Two-Tier Workforce

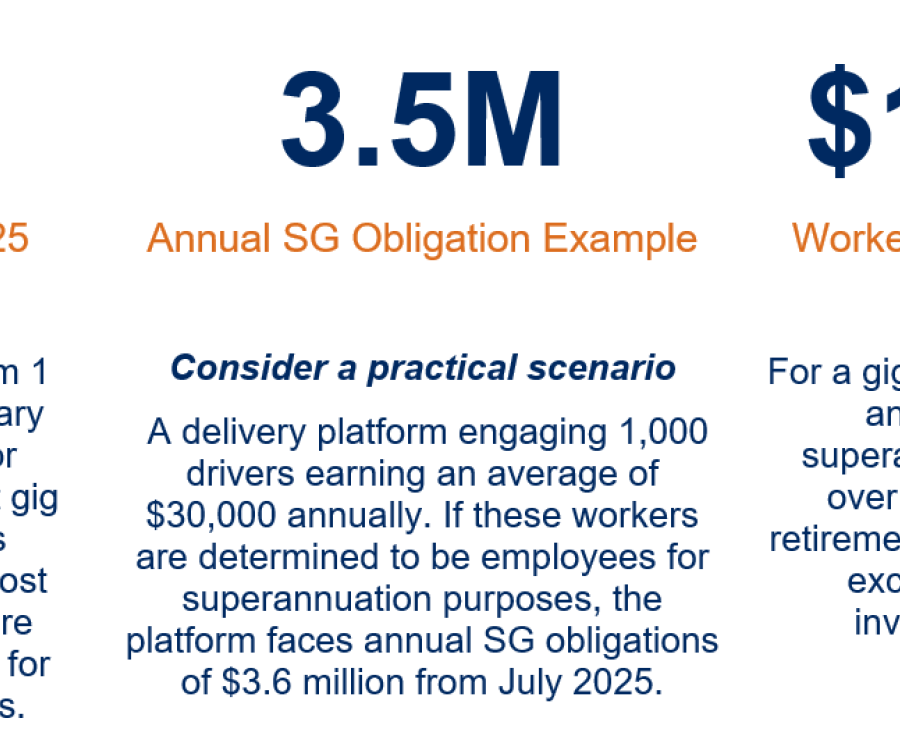

The significance of this issue is only growing. From 1 July 2025, the super guarantee the percentage of wages employers must pay into super accounts will rise from 11.5% to 12.0%.

While this is a positive step for traditional employees, millions of gig workers remain outside the system, creating what industry analysts describe as a two-tiered workforce with vastly different retirement outcomes.

For businesses engaging gig workers, the classification question presents mounting compliance risks. The Australian Taxation Office (ATO) continues to update its guidance on who counts as an employee for superannuation purposes, creating uncertainty across industries from ride-sharing to delivery services. Companies face potential penalties while workers miss out on crucial retirement savings, highlighting a system struggling to keep pace with modern working arrangements.

This article explores the classification minefield facing Australian businesses, the financial implications of getting it wrong, and the growing calls for regulatory clarity in an economy where traditional employment boundaries are increasingly blurred.

The Classification Minefield: Law, Guidance, and Grey Areas

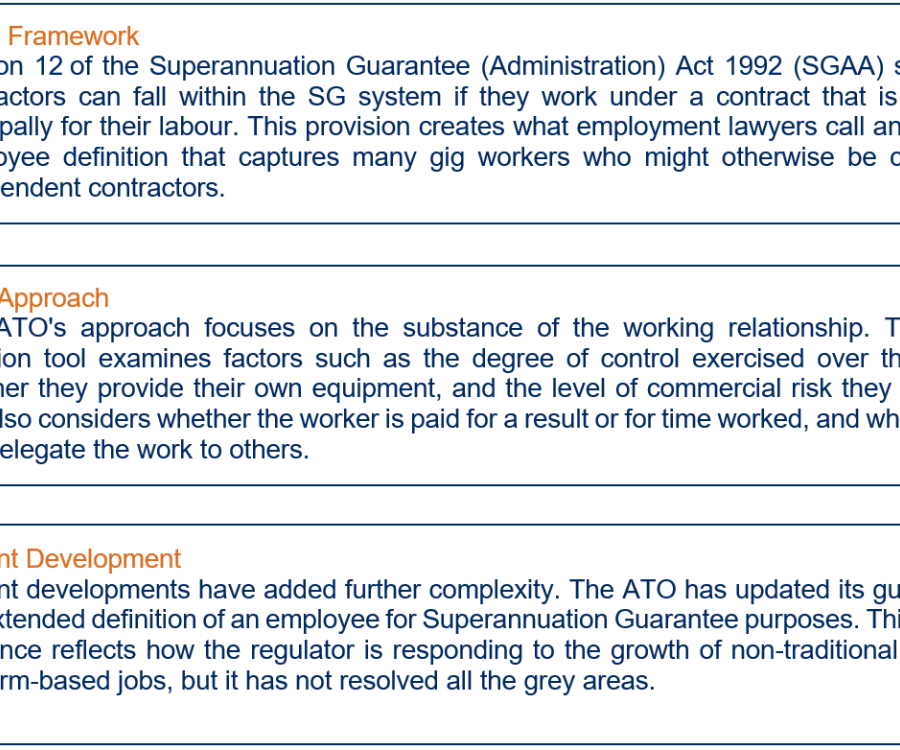

Determining whether a worker is an employee or contractor now carries enormous financial consequences. Under current Australian law, businesses must work through a complex checklist to determine their superannuation obligations, with the ATO providing guidance that goes well beyond traditional employment relationships.

The practical implications are far-reaching. Food delivery drivers, ride-share operators, and freelance service providers could all fall within the superannuation guarantee system, depending on how they actually work. The challenge for businesses is applying these tests consistently while managing the costs and paperwork.

For smaller businesses, this complexity presents particular challenges. A small logistics company engaging casual drivers faces the same classification hurdles as larger platforms but often lacks the resources for sophisticated compliance systems. Many are turning to payroll outsourcing services to access advanced classification technology and expert guidance without the substantial upfront investment in systems and specialist staff.

Industry-specific examples show the complexity. Platform-based businesses operating across multiple states must work through different interpretations of employment relationships, with some workers potentially classified differently depending on where they work or how they're engaged. The lack of definitive court decisions in many emerging gig economy sectors adds to the uncertainty.

Worker classification has become a strategic business decision. Companies are spending money on legal advice and compliance systems to ensure accurate worker classification, while others are restructuring their operations to reduce superannuation guarantee exposure. This uncertainty is driving substantial costs across the economy as businesses try to manage their compliance obligations.

The Numbers Game: Misclassification and Financial Consequences

The financial implications of misclassification extend well beyond missed superannuation contributions. The ATO's penalty regime for SG non-compliance creates substantial liability for businesses that incorrectly classify workers as contractors when they should be treated as employees for superannuation purposes.

The penalty structure makes the financial impact worse. If required superannuation payments are not made by the quarterly due date, businesses must pay the super guarantee charge. This charge includes not only the missed super contributions but also additional penalties and interest, creating a multiplier effect that can significantly exceed the original obligation.

The retrospective application of penalties for past non-compliance could result in substantially higher liabilities when interest and penalty components are included.

Compliance costs add another layer of financial impact. Businesses are investing in payroll systems capable of handling complex worker classification scenarios, legal advice to assess worker status, and administrative processes to manage different superannuation obligations.

For smaller businesses, these compliance costs can be proportionally much higher. However, outsourcing payroll functions to specialist providers has emerged as a cost-effective solution. These services offer access to sophisticated classification technology, regulatory expertise, and automated compliance processes that would otherwise require substantial internal investment. Rather than building in-house capabilities, many small to medium businesses are finding that payroll outsourcing provides enterprise-level compliance tools at a fraction of the cost.

New Powers, New Risks: Regulatory Evolution

The regulatory landscape governing gig work continues to evolve, with new powers and enforcement mechanisms creating additional compliance risks for businesses. The Fair Work Commission's expanded jurisdiction over certain categories of workers is reshaping the employment relationship framework and potentially influencing superannuation obligations.

These regulatory developments reflect growing policy attention to worker protections in the gig economy. The traditional binary classification of employee versus contractor is being challenged by hybrid categories that could capture gig workers while providing some employment protections without full employee status.

The UK, for example, has introduced a dependent contractor category, recognising workers who fall between employee and contractor status and granting them certain rights such as minimum wage and holiday pay. This approach has been cited in Australian policy discussions as a potential model for bridging the gap in worker protections, though no equivalent exists in current Australian law.

The timeline for regulatory change remains uncertain, with various government consultations and policy reviews underway. The potential for retrospective application of new requirements adds to the compliance complexity.

This evolving regulatory environment creates strategic planning challenges for businesses operating platform-based models. Investment decisions, pricing strategies, and operational structures all require consideration of potential regulatory changes and their associated compliance costs.

Platform Responses and Workarounds: Adapting to Uncertainty

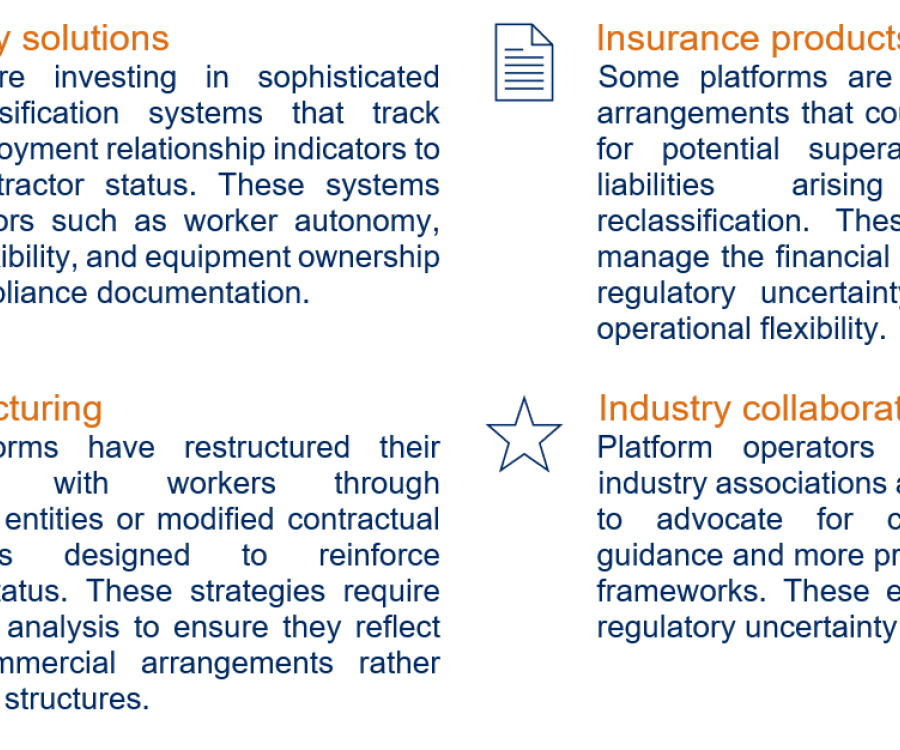

The gig economy's major platforms have responded to superannuation classification challenges through various operational and structural adaptations. These responses reflect the substantial compliance risks associated with worker reclassification and the need to maintain business model viability while managing regulatory obligations.

The effectiveness of these adaptations remains to be tested through regulatory enforcement and potential legal challenges. The ATO's substance-over-form approach means that operational reality rather than contractual documentation will ultimately determine classification outcomes.

The Worker Perspective: Navigating the Super Gap

From the worker's perspective, the superannuation guarantee gap represents a significant retirement savings challenge. Gig workers face the dual burden of managing their own superannuation contributions while potentially missing out on employer contributions that would be available in traditional employment relationships.

If you earn under $60,400 in the financial year ended 30 June 2025, the Government can chip in up to $500 to help boost your super when you make a voluntary non-concessional (after-tax) contribution. However, this co-contribution scheme provides limited compensation for missed employer superannuation guarantee contributions, particularly for higher-earning gig workers.

Worker awareness of superannuation entitlements varies significantly across gig economy sectors. Many workers assume their contractor status exempts them from superannuation guarantee coverage, while others are unaware of the potential for reclassification based on their actual working arrangements.

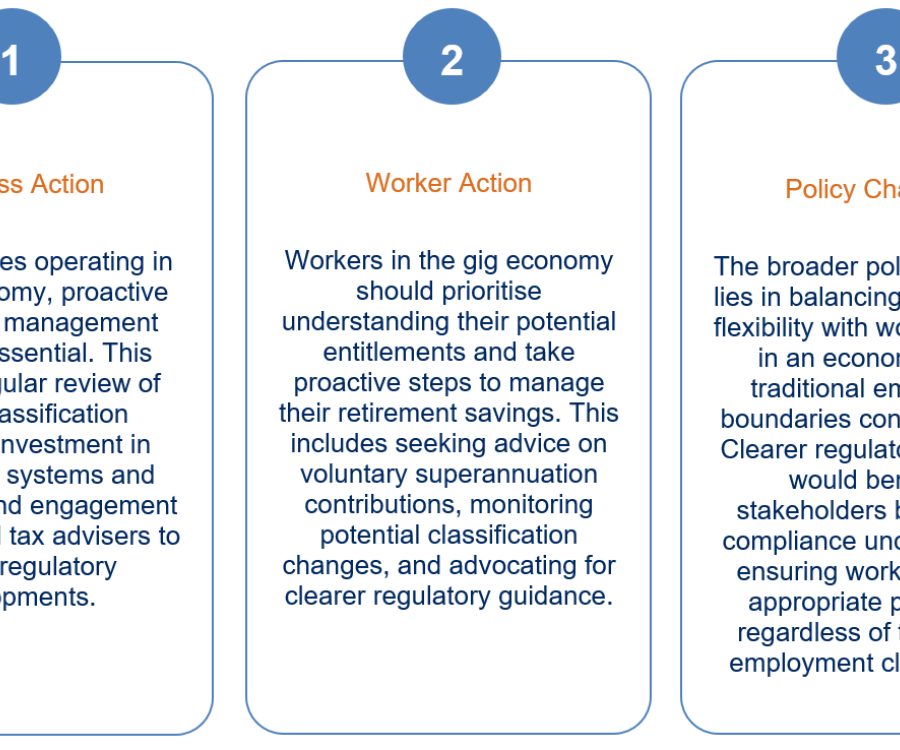

Advocacy groups have responded to these challenges through campaigns for broader superannuation coverage and clearer worker classification guidance. These efforts highlight the policy tension between employment flexibility and worker security in the evolving economy.

The worker perspective also encompasses the administrative burden associated with self-managed superannuation contributions. Gig workers must navigate complex superannuation rules, manage irregular income streams, and make voluntary contributions without the automatic payroll deduction systems available to traditional employees.

Looking Forward: The Path to Clarity

The regulatory trajectory suggests continued evolution in gig economy worker protections, with superannuation guarantee coverage likely to remain a key policy battleground. Businesses should anticipate more detailed guidance from regulators, enhanced enforcement activities, and potential legislative changes that could expand employee definitions for superannuation purposes.